The Simplest ‘SaaS Packaging’ Strategy You Will Ever Need

In prevailing conversations around SaaS pricing, the role of packaging continues to be a dominant one. This Forrester blog highlights how important it is to consider which packaging approach is best for your offering to ensure its success.

We’ve already looked at another important component to price well, and that’s positioning. Once that’s determined, the next step is to create 'offers' that will work for your targeted market segments. These offers are the right combination of feature sets, services, and prices for a market segment that will ensure that you can derive the maximum possible value from within that segment.

The set of capabilities in an offer, except the price itself, constitutes a package. In most cases, you will want to create a set of packages that map 1-1 to the number of clearly defined market segments.

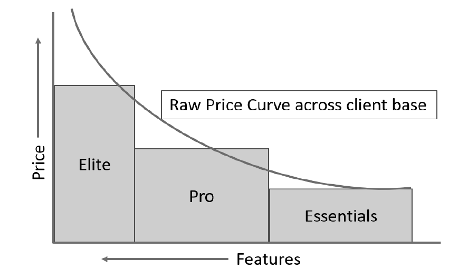

Let's use the following figure to understand how packages help:

If we were to draw out a curve that represented how prospects valued a solution when varying the feature-set, we would obtain a curve that looked similar to the one in Figure 4. Intuitively, prospects who need more features (or more advanced features) tend to pay more than prospects who need fewer features. If no pricing model exists, then a time-averaged curve of product ACV (Annual Contract Value) across different customers who had varied usage in features would also look similar.

The goal of establishing a pricing model is to standardize 'packages/offerings' that allow your firm to run a sales engine that helps you achieve a curve like the one above. The curve is maximized for its return from prospects and one that helps you achieve efficiency with your sales engine (via a well-defined pricing model). Unless you sell to a very homogenous set of prospects (e.g., Fortune 100 - Pharma companies), you will want to come up with a packaging structure that lets you capture a progressive amount of value across your customer segments.

What is a relatable example of packaging?

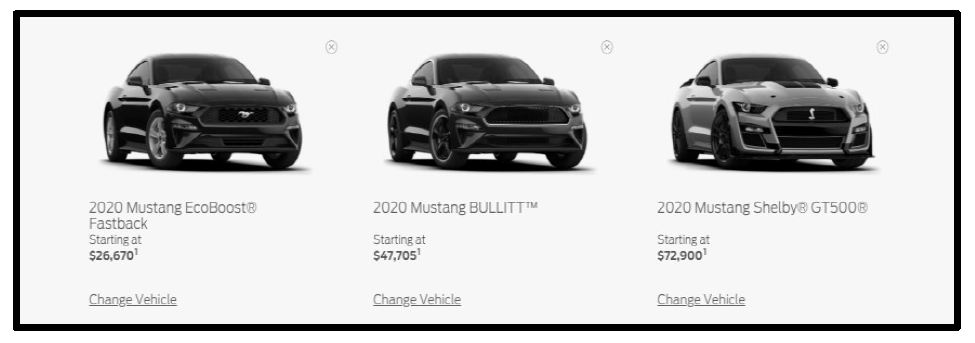

A customer may be looking to buy a Ford Mustang. All Mustangs are built on a common base, but each model is priced based on the variations in features offered - horsepower, engine specs, shell, interiors, etc.

The sports car aficionado, who is heuristically inclined to associate a Mustang as a status symbol, will be willing to spend more and opt for the Mustang Shelby GT500. The base model of the Mustang EcoBoost Fastback would not have the level of specs that the GT500 would offer. There would also be discerning customers who want more features than the base model offers but aren't willing to splurge on the most high-end model. The manufacturer assesses this segment as well and offers the Mustang BULLITT for them - priced between the base and high-end models. This is a good example of how the manufacturer is looking to maximize the area beneath the curve by offering multiple features of a relatively horizontal product through packaging variations.

This logic applies similarly to software packaging.

So how do you create packages for software?

In my experience, there are roughly two ways to go about this exercise:

- Good-Better-Best (GBB): It is becoming common in SaaS to create 2-3 step graded packages, nicknamed good-better-best packaging, for different customer segments and to map these packages to different price points that those segments will be able to bear. Different sets of features are grouped into a package and targeted at different market segments so as to provide a set of capabilities that do the best job of solving the segment's main use cases. This approach works well in capturing revenue from a market that has a large set of prospects with less variance in their willingness to pay or avg deal size, and often these are SMB and Mid-Market segments. Here deal velocity takes precedence over finely tuned price points. For expert insights on Good-Better-Best-Packaging, here’s a link to another blog on this site.

- Modular: This approach involves attributing value to distinct groupings of features that unlock specific use cases for your prospects. The modularity enables your packaging to vary considerably between any two given customers. This works better in a market where there is a high variance in willingness to pay (WTP) and the average sale price (ASP), and a smaller universe of prospects. In these situations, a high revenue capture rate is more important than velocity. For such cases, flexibility is usually king, and a well-designed, bespoke-fit type of package can help maximize revenue capture in this segment. More on how to nail your modular packaging here.

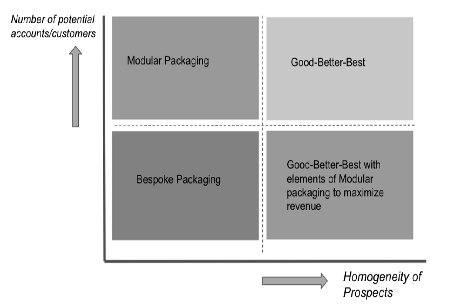

The following figure illustrates roughly how I visualize the decision of selecting a specific approach.

A Good-Better-Best model is better suited for when there is a large 'n', i.e., number of customers/accounts available in the market to be sold that are somewhat homogenous in their needs. For example, direct to consumer, digital-first companies in the eCommerce vertical.

On the other hand, the modular approach would be better if the market was more heterogeneous. For example, when the same product is sold to insurance, telco, retail, and/or hospitality where all these industries have varying needs.

When the total market 'n' is small, the market is also heterogeneous. In that case, depending on the circumstance, one can make an argument for creating bespoke packages per client. For example, a selection of 20 top financial issuers with varying use cases for a data science platform.

At the end of the day, while there are no rules to this, it helps make your decision process clearer. Once you understand these techniques, you can always mix and match them for the best effect.

It’s worth remembering what this EY study says, “As SaaS companies focus on creating value for their customers, product packaging is the secret weapon to increase that value for priority customer segments, further enhancing their willingness to pay.”

-------------------------------------------------------------------------------------------------

This blog contains excerpts from author Ajit Ghuman's book, Price To Scale. Buy your copy now on Amazon.com

Image Credits: All images are as previously published in Price To Scale.